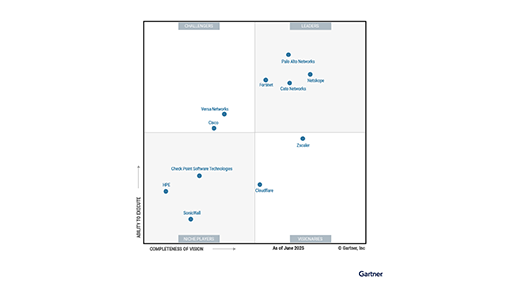

In case you missed it, Netskope was once again named a Leader in the Gartner® Magic Quadrant™ for Security Service Edge (SSE), placed highest in Ability to Execute and furthest in Completeness of Vision. 2024 is the third year in a row that Netskope has been named a Leader in this important Magic Quadrant and the second year to be placed Highest in Execution and Furthest in Vision.

Along with the Magic Quadrant report, Gartner also released the 2024 Gartner® Critical Capabilities for Security Service Edge report. In the Critical Capabilities report, Netskope scored among the highest ranked three vendors for all four Use Cases surveyed, including scoring the highest in both the Secure Web and SaaS Usage and Consolidate Vendors Use Cases.

We believe that these two reports and others tell us much about where SSE and the overall market for SASE—of which SSE represents the critical security stack—are headed, and also the ways in which vendors in this market will successfully adapt to its changing needs.

The Platform Shift

Both the SSE Magic Quadrant and the Critical Capabilities report share strategic assumptions. For example, Gartner predicts that by 2026:

- 85% of organizations seeking cloud access security broker (CASB), secure web gateway (SWG), or zero trust network access (ZTNA) offerings will obtain them from a converged product, as per the Critical Capabilities for SSE report.

- 45% of organizations will prioritize advanced data security features for inspection of data at rest and in motion as a selection criterion for SSE, as per the Magic Quadrant for SSE.

The strengths of our unified SASE platform, Netskope One, correctly anticipate and align to the market trends, especially that advanced data protection must be at the heart of any true SSE strategy, and that all of the mentioned security capabilities need to converge into, yes, a unified platform.

This shift toward platform is well underway; previously, customers would need to acquire a set of discrete technology capabilities from multiple vendors, but today, they can buy CASB, SWG, ZTNA, RBI, FWaaS, SD-WAN, and other capabilities from just one, with the right architecture needed to converge them usefully, and performantly. There won’t be one overall platform for ALL of security and networking—we’ve talked at length about why that’s not feasible—but the segments of security and networking that should shift toward platforms, are already shifting toward platforms. SASE is unquestionably one of them.

So what are the keys to meeting customer demand both today and going forward, if there are going to be fewer and fewer relevant SSE and SASE players in the coming years as a result of not clearing the high-bar for a successful platform approach?

1. The strengths of the individual SSE and SASE capabilities themselves have to stand out. “Good enough” never will be enough for customers that have spent years building architectures based on best-in-class technology.

In this aspect, Netskope has never stopped innovating, from the AI and machine learning that have been present in Netskope products since our earliest days, to the advanced aspects of what Netskope One can do that enable complete (not just halfway promise) VPN replacement.

2. Architecture matters.

Customers don’t want “price list platforms,” which is when a vendor acquires capabilities, puts them all on a price list, and says, “OK, here’s your platform!” just because it has all of the pieces to sell. Poorly integrated acquisitions ensure the technology environment gets more complicated, the products don’t work well together, policies are fragmented, management isn’t simplified, and customers spend more time hoping for platform value than you do receiving it. That the pieces are well integrated—and the architecture is purpose-built—is what distinguishes genuine capability integration from mere product aggregation.

Architecture matters in other ways, too. If the underlying network delivering these SASE capabilities is fragmented, dependent on legacy routing frameworks, or strained by advanced security features, then the promise of a truly converged networking and security platform isn’t met, and we’re back to the longtime (and frustrating!) compromise of security that slows the network, or the network that runs fast, but not securely. Netskope was cited throughout the recent Forrester Wave™: Security Service Edge (SSE) Solutions, Q1 2024—on the coverage provided by our NewEdge infrastructure, which enables the seamless delivery of both robust security and a phenomenal, localized user experience. Part of why we can do this is that NewEdge is our own private network and not dependent on third-party public cloud infrastructure.

3. Future roadmap vision can’t stall.

We’re proud that Netskope was cited in several reports for our roadmap and how we’re adapting to where the market is headed. In security, especially, failure to invest in innovation—including R&D—is a recipe for future irrelevance. Tomorrow’s execution is borne from today’s leadership.

At Netskope, we believe we’ve built trust over a long period of time through a commitment to innovation, and that won’t change. No vendor can emerge from nowhere with a full platform that can deliver SSE and SASE today; arriving here meant committing to a vision much earlier than the terms “SASE” and “SSE” existed, and seeing it through as the world moved toward cloud and SaaS and hybrid work much faster than once anticipated. Together with our customers and partners, we will continue to innovate, and we will continue to serve the needs of the market every day.

If you’d like to learn more about the vendors and capabilities surveyed, read the full Magic Quadrant for SSE.

Gartner, Magic Quadrant for Security Service Edge, Charlie Winckless, Thomas Lintemuth, Dale Koeppen, 18 April 2024.

Gartner, Critical Capabilities for Security Service Edge, Charlie Winckless, Thomas Lintemuth, Dale Koeppen, 17 April 2024.

Gartner Disclaimer

Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

GARTNER is a registered trademarks and service mark, and MAGIC QUADRANT is a registered trademark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and are used herein with permission. All rights reserved.

Retour

Retour

Lire le blog

Lire le blog